Customizing Liability Credit Insurance: New Products for Unique Business Needs

Modern business environments present unpredictable conditions through which organizations face complicated risks which combine operational challenges and financial uncertainties alongside legal exposure. The unpredictable business environment exposes all industries to operational, financial and legal risks including delayed payments from clients and contract breaches as well as digital scams and product-related legal actions. Businesses encounter difficulties when they depend on traditional insurance packages to safeguard their unique modern-day risks.

Customized liability credit insurance has emerged as an essential requirement for today’s businesses. As businesses move forward through digital transformations and international market entries and new product launches insurance providers deliver customized innovative insurance solutions. The recent insurance product offerings accommodate specific business requirements that particularly benefit industries at risk from both credit and legal challenges.

This blog delves into both the necessity of tailored liability and credit insurance solutions and demonstrates how new hybrid insurance solutions formed from coverage including Indian cyber insurance and product liability insurance policies, and D&O insurance coverage now function as essential tools for companies to manage their risks.

The Need for Customization in Liability and Credit Coverage

Prior to the modern era businesses conducted operations in separate functional areas and so liability policy and trade credit insurance were created. Modern supply chains operate across international borders and cyber threats attack in real time while reputation damage from social media typically emerges quickly.

Standardized insurance terms regularly create weak spots which expose policyholders to risks. For example:

- Product and liability insurance protects manufacturers but payments from defaulting distributors often remain beyond these insurance components’ scope.

- A technology company might buy a cyber insurance policy yet fail to secure cover for cyber fraud which leaves them vulnerable to email fraud and online financial attacks.

- Standard liability coverage breaks down because executives remain exposed to private liability scuffles even when their public obligations are secured by existing policies. Therefore such cases demand D&O insurance protection.

The mismatch between insurance needs and available coverage has created rising interest in versatile risk bundle solutions which adapt to specific business operational scenarios.

Liability Meets Credit: A New Class of Hybrid Insurance Products

The newly emerging liability credit insurance combines protection for credit risks with coverage against third-party liability claims. This dual strategy proves beneficial for companies conducting business in unstable markets along with multinational clients who face both financial default and legal disputes.

Modern solutions continue to develop according to the following patterns:

1. Trade Credit Insurance with Legal Liability Extensions

Businesses can integrate legal liability features to their trade credit insurance policies under modernized coverage packages. The insurance protection safeguards stakeholders against both payment defaults and potential post-delivery contractual conflicts and third-party claims referring to late deliveries.

2. Modular Add-Ons for High-Risk Sectors

Many insurance providers provide modular programs that allow companies to pick coverage standards matching their particular industry requirements. For example:

- Indian IT companies should consider three key components of cyber insurance which cover network security liability alongside data breach costs and digital third-party infringement protection.

- Manufacturers benefit from product and liability insurance bundles which enable them to extend their safety coverage with product liability insurance policy upgrade features during product recalls or safety-related lawsuits.

3. Executive & Employee Risk Protection

Today’s businesses are adding D&O insurance coverage (Directors and Officers Insurance) to their existing protection plans. The insurance protects senior executives against potential personal liabilities that can arise during disputes of fiduciary, operational, or regulatory nature.

Modern commercial general insurance packages now integrate employee crime protection together with internal fraud prevention while relying on crime insurance and cyber fraud insurance.

Industry-Specific Customization Examples

Specialized insurance solutions emerge from insurance providers in response to the diverse needs encountered across different business sectors.

1. Technology and E-Commerce

Fast digital progress during service delivery and customer engagement exposes technology firms to broad data security threats alongside phishing attacks and software failure vulnerabilities.

Customized coverage includes:

- Digital infrastructure alongside customer data receives coverage through a specialized insurance policy named cyber insurance.

- Businesses seeking protection against email-based fraud and cybersecurity threats and unauthorized funds transfers can find coverage through cyber fraud insurance.

- A third policy type which integrates proteinfinity insurance and public liability insurance allows coverage of both user injuries and service failures leading to financial damage.

2. Manufacturing and Consumer Goods

These companies face multiple threats stemming from defective product designs together with problematic batch production and disruptions throughout their supply networks.

Recommended customizations:

- Trade credit insurance along with product and liability insurance provides coverage for both product recall expenses and customer payment non-payment incidents.

- Insurance protection specializing in product liability coverage with worldwide compliance regulations for international markets.

- The business benefits from commercial general insurance plus added coverages for fire protection and machinery breakdown and warehousing risks.

3. Professional Services and Consulting Firms

Service-based businesses face primary risks from their reputation and advisory functions. Here, customized insurance might include:

- Businesses should purchase D&O insurance for protecting their partners as well as directors.

- Companies in India use Cyber insurance policies to protect their client data along with their company systems.

- Crime insurance against embezzlement along with protection against fraudulent client management activities.

The Role of Digital Platforms in Customizing Insurance

InsurTech platforms and digital insurers enable businesses to transform their insurance needs through modern access and modification tools. Business owners benefit from these platforms through their ability to apply data analytics and AI along with industry benchmarking standards.

- Real-time assessment of operational risks forms part of their service.

- Choose from modular coverage options.

- Manage policies, file claims, and renew services effortlessly.

Indian digital insurers operate online platforms that present customers with bundled services such as cyber insurance India together with trade credit insurance and commercial general insurance.

This modern approach cuts manual processes and mistakes and enables policies to evolve with both growing companies and new market operations.

Key Benefits of Customized Liability Credit Insurance

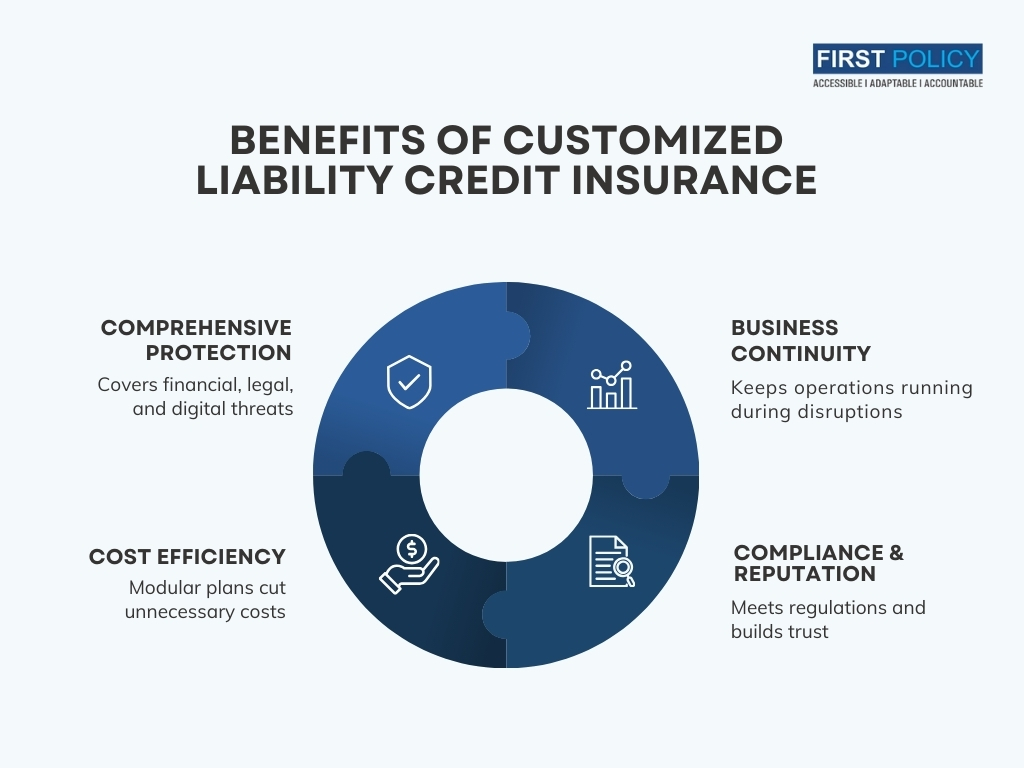

The main benefits from custom-made liability credit insurance policies include:

- Comprehensive Protection: The pool of coverage protects businesses against non-payment lawsuits while offering defense against third-party claims in addition to digital security protection and management mistakes prevention.

- Business Continuity: The policy protects business operations from being disrupted through instances of fraud together with legal action and bankrupt customer collapses.

- Cost Efficiency: Businesses get the most value for their money when they choose modular coverage because it eliminates protective layers that provide no benefit.

- Compliance and Reputation: The coverage fulfills all relevant industry rules while maintaining brand trust and existing client partnerships.

Looking Ahead: Why Customization Isn’t Optional Anymore

Today’s developing risk environment mandates specific risk management approaches for every business. Various risks require specific strategies which cover everything from international cyberattacks and supplier payment delays to immediate product recalls.

The implementation of customized liability insurance policies together with modern cyber cover and crime protection and specialized product coverage has moved beyond being optional business practices. These strategic tools represent essential components for actively managing a business enterprise.

Companies that select next-generation customized insurance solutions develop financial shields while increasing marketplace success and earning client confidence within difficult markets.

FAQ’s

It also provides cover for contemporary risks such as cyber risks, product recall, and delayed payments among others covering a more specific sector than insurance.

This type covers credit risk in the buyer’s contract and legal risks related to contracts by ensuring that the buyer does not pay the seller.

Yes, some companies, especially in hi-tech and manufacturing industries, are able to select certain coverage categories, say cyber and product recall insurance.

InsurTech platforms use data analytics and AI to allow businesses to easily modify policies, assess risks in real-time, and manage claims online.

It offers complete coverage, facilitates the continuance of a company’s operation, reduces costs and helps organizations meet set standards.