Factory Insurance in India: Why Manufacturers Need It

The manufacturing units are the pillar of the industrial development and make a considerable contribution to the economy. On the other hand, there are many risk factors involved with factories like fire, machinery breakdown, theft, or natural disasters. Disruption to operation, financial losses & legal liabilities due to an unexpected event The factory insurance India is a comprehensive protection needed to secure manufacturing businesses.

Read this blog to know about importance, benefits of factory insurance India, and how manufacturers can consider additional policies such as construction all risk insurance, warehouse insurance, contractors all risk insurance.

What is Factory Insurance?

Factory insurance India is a specialized cover plan specifically created to secure manufacturing plants, equipment and goods against unexpected loss. It includes financial losses that result from:

- Fires, explosions, and natural disasters

- Machinery breakdown, electrical failures

- Theft, break-in and vandalism

- Third-party liability claims

- Workplace accidents and employee injuries

Manufacturing operations consist of heavy machinery, chemicals, and labor-intensive processes so the right coverage is essential for business continuity.

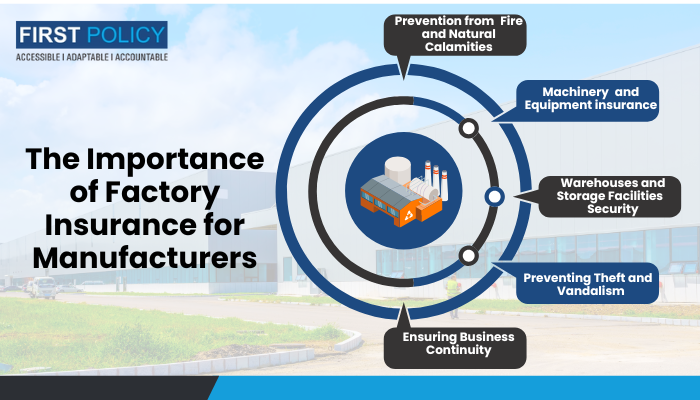

The Importance of Factory Insurance for Manufacturers

- Prevention from Fire and Natural Calamities

Factory premises, infrastructure, and machinery including the factory inventory are susceptible to damage caused by disasters like floods, fires, and earthquakes. In other words, Property Insurance in India provides coverage against such risks to ensure quick recovery and rebuilding.

- Machinery and Equipment insurance

This is because factory operations require expensive machinery and tools. If production stops due to a sudden breakdown or malfunction, it will result in the loss of revenue. Construction all-risk insurance and contractors all risk insurance protect machinery from damages, which aids in managing the costs of repair and replacement.

- Warehouses and Storage Facilities Security

Factories keep raw materials and finished goods in warehouses and godowns, which creates a risk of theft, fire and damage. Storing goods in warehouses or godown poses concentration risk, such as loss due to fire or theft.

- Preventing Theft and Vandalism

Factories store valuable raw materials, equipment and finished goods, making them prime targets for thieves and vandals. Factory insurance in India saves you from such situations, avoiding the financial hit.

- Liability Protection and Legal Compliance

Factories have to comply with safety regulations, and any accident can be a target for legal claims and penalties. Contractors all risk insurance provides liability coverage that protects manufacturers against third-party claims regarding damages to property or injuries to workers.

- Ensuring Business Continuity

Some unexpected events — fires, machinery breakdowns or theft — can stop production for weeks. Manufacturers can resume production without delay as their property insurance in India provides them the financial support needed to cover their operational losses.

Key Considerations When Choosing Factory Insurance

Comprehensive Coverage –

Manufacturers should select a policy that includes:

- Buildings and industry infrastructure

- equipment and tools and machinery

- Stock and raw materials kept at warehouse and godowns

- Third-party liability and worker safety

Understanding Exclusions –

It’s important to read the exclusions in a policy. Some policies might not cover normal wear and tear, deliberate damage or preexisting conditions.

Claim Settlement Process –

Selecting a policy that offers a hassle-free and transparent claim settlement will ensure that you can recover your funds as quickly as possible.

Risk Management Strategies –

Your company may lower risk and lower insurance premiums by implementing safety measures — including fire safety systems, surveillance and employee training.

Conclusion

Manufacturers need to purchase factory insurance India for a long-term covering against damages. Whether it’s warehousing insurance, godown insurance, or anything in between, complete coverage protects factories from fire, theft, natural disasters, and operational medium.

In addition to this, construction all risk insurance and contractors all risk insurance protects equipment and the construction project, as well as provides coverage against third-party liabilities. Manufacturers can safeguard their assets, ensure financial stability, and secure uninterrupted operations by selecting the right types of insurance policies. Property insurance in India is an investment today with a secure and resilient tomorrow for manufacturing industries.

FAQ’s

1. Why do manufacturers need factory insurance in India?

Manufacturers face multiple risks such as fires, machinery failures, theft, and workplace accidents. Factory insurance ensures financial security, business continuity, and compliance with legal requirements.

2. What role does machinery breakdown insurance play in factory insurance?

Machinery breakdown insurance covers repair and replacement costs for expensive factory equipment. Policies like construction all risk insurance and contractors all risk insurance protect against sudden machinery failures, preventing production delays.

3. What role does machinery breakdown insurance play in factory insurance?

Machinery breakdown insurance covers repair and replacement costs for expensive factory equipment. Policies like construction all risk insurance and contractors all risk insurance protect against sudden machinery failures, preventing production delays.

4. How does factory insurance help with legal compliance and liability protection?

Factories must comply with workplace safety laws. Contractors all risk insurance provides liability coverage, protecting manufacturers against third-party claims related to property damage or worker injuries.

5. How do contractors all risk insurance complement factory insurance?

Contractors all risk insurance covers liabilities related to factory construction, equipment installation, and project risks, protecting businesses from unexpected financial losses during expansion or renovations.